RIMANSI, through the support of Citi Foundation, conducted a Learning and Sharing Forum showcasing the key results of the 18-month project on Building Microinsurers Capacities for Greater Financial Inclusion attended by close to 60 participants last November 24 in Butuan City.

The multi-stakeholder forum is the culminating activity of the project with Citi Foundation which supports the growth strategy of Microinsurance Mutual Benefit Associations (Mi-MBAs) through capacity building interventions on governance and management, new product developments, established investment policies and growth options.

Board, management and staff of Mi-MBAs within the RIMANSI network gathered in the forum to learn from the experiences of other Mi-MBAs, their partners and key stakeholders, the lessons and leadership programs they developed during the implementation of the grant. The forum was also an opportunity to recognize top Mi-MBAs that developed their own risk assessment framework.

Further, participants eagerly exchanged learnings and presented best practices on business continuity and disaster recovery planning, investment planning, regulatory framework for product bundling, and cash flow management and tax planning.

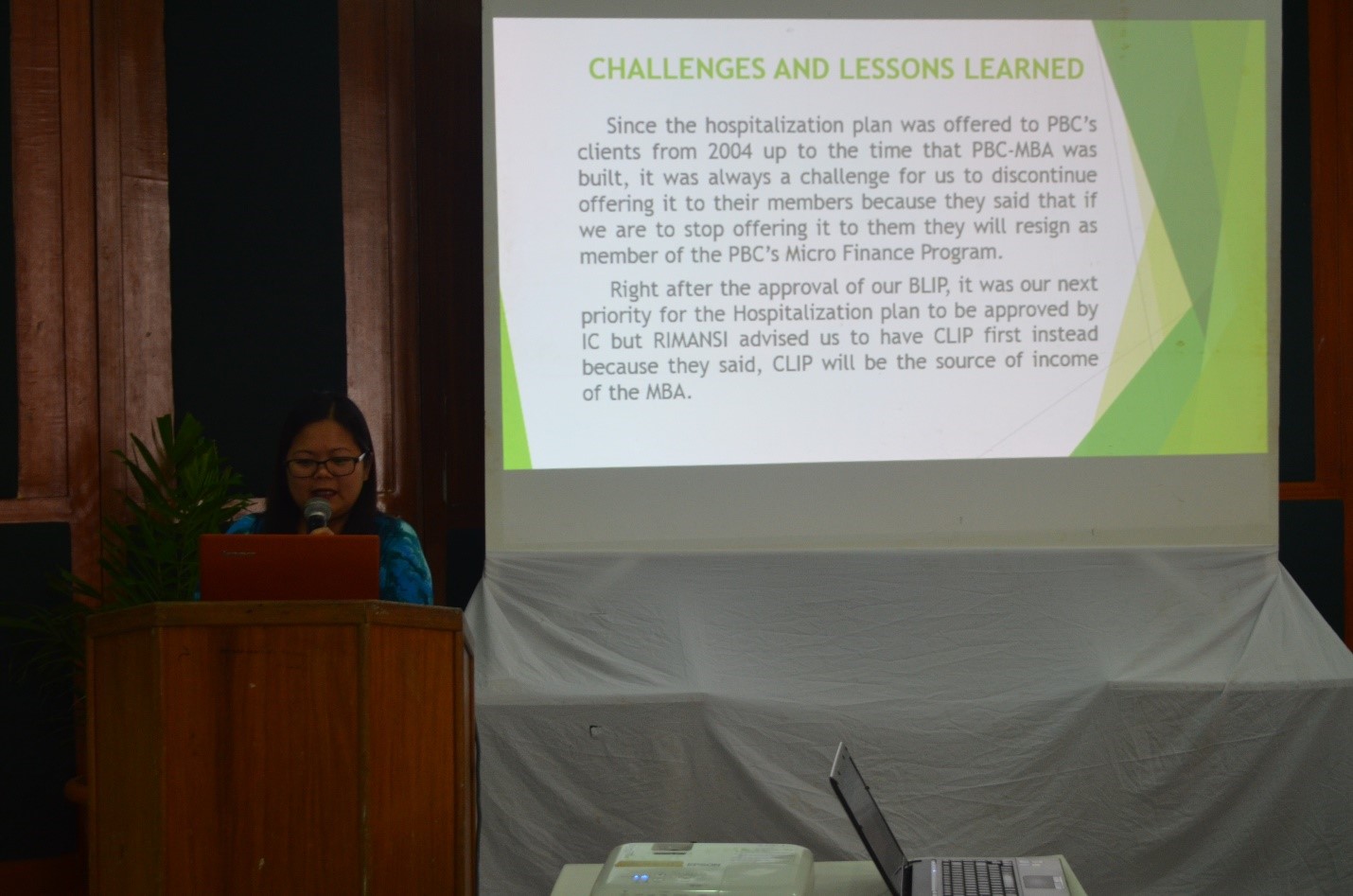

TSPI MBA shared their way of returning surplus to its members through conducting training and development services, health and sanitation programs and disaster assistance programs. PBC MBA presented their recently approved product, the Hospitalization Assistance Pampamilya Insurance Plan (HAPI Plan) which allocates hospitalization and maternity benefits for all of its members.

More so, Maria Teresa Gonzales, KCCDFI MBA General Manager, was particularly interested in the investment planning session, “I’ve learned that we should always take into consideration compliance with regulations and make sound decisions when investing the funds of the policyholders as protecting the funds that has been entrusted to us should always be a priority. I have also realized the importance of sound investments, which when done properly, can support administrative expenses and may also add value to the delivery of our product.”

With the equipped and trained Board and management team, Citi Foundation hopes to see crafted policies and strategies that will promote a more responsive, accessible and affordable microinsurance products and services, complemented by faster claims payout performance. Sound investment policies which can bolster the financial viability of the MBAs to be able to sustain its mission for greater financial inclusion is also expected of these activities.

The project supported by Citi Foundation commenced last June 2016 and is expected to conclude by January 2018.