Gearing Towards Sustainability and Inclusion through FinTech Ed Efforts. Changes in contemporary society continue to highlight the volatility of the microinsurance industry. For one, the call for digitization is as tantamount as ever with the need for microinsurers to adapt to modern tools and processes. Not to mention the risks faced by the members also evolve with global changes, such as the pandemic and climate change.

Mi-MBA Members - Partners

Membership

Individuals Insured

Contribution, Premium

Amount of Claims Paid

Equity Value, Cumulative

Equity Value For The Year

Released Amount of Equity Value

Total Number of Claims Paid (BLIP)

Average Amount of Claims Paid per Day

Average Number of Claims Paid per Day

Stories Behind Us

#NMiForum2022 Session 1

Improving climate resilience of poor & developing communities

#NMiForum2022 Session 3

Securing protection & resilience of MSMEs

#NMiForum2022 Session 2

Managing products & distribution innovations

#NMiForum2022 Session 4

Improving employment environment

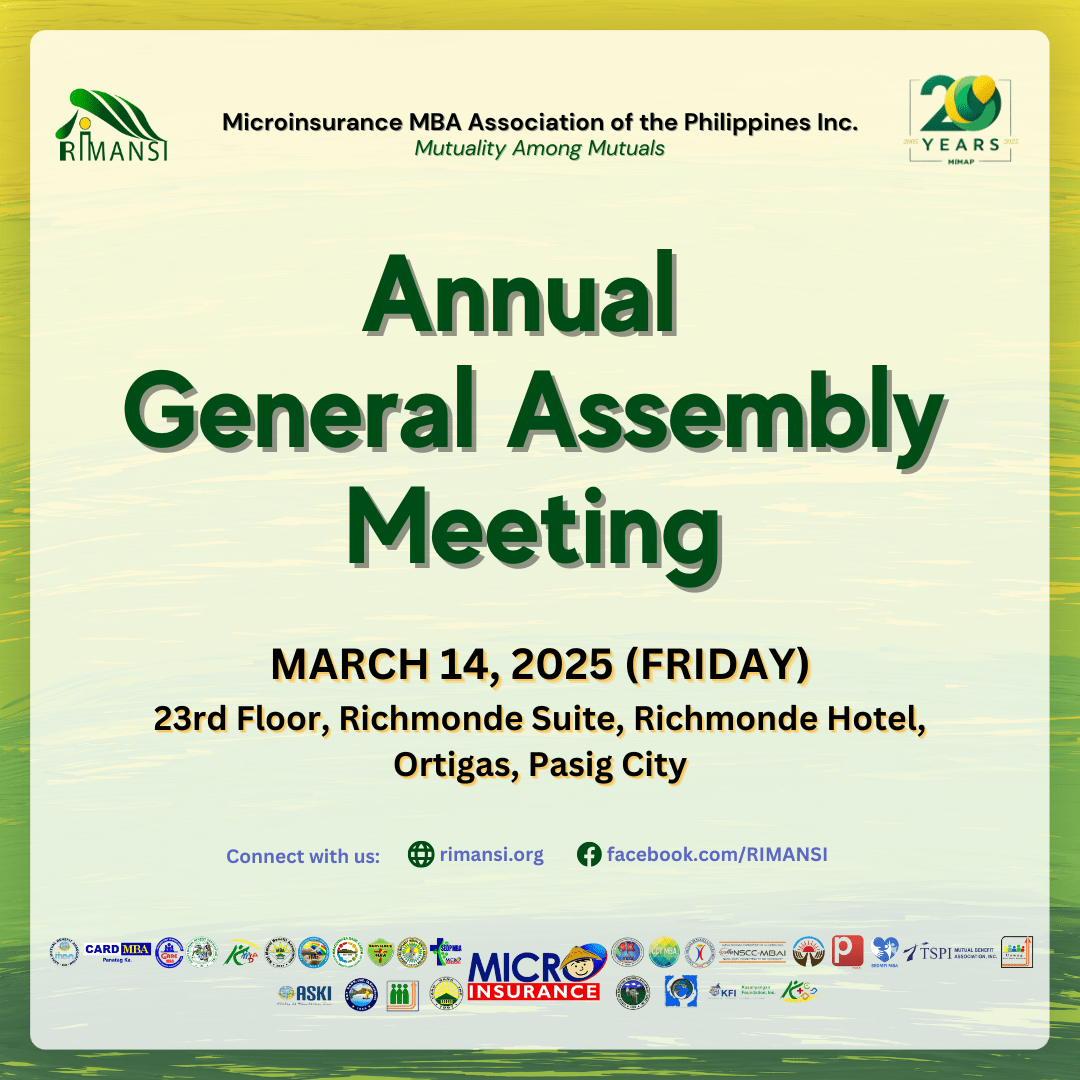

Microinsurance MBA Association of the Philippines Inc.

1014 Medical Plaza Ortigas Bldg.

San Miguel Ave. Pasig City Philippines

Tel No. 8706-2561

Email: secretariat@rimansi.org / rimansi@yahoo.com