The Microinsurance MBA Association of the Philippines Inc. (MiMAP), also known as RIMANSI, held its first learning session of the year entitled “Ensuring Efficient CLIP Administration: The CARD MBA Way” on February 21, Tuesday.

The two-hour online event was attended by more than 70 members of the Board and management staff from 13 Microinsurance-Mutual Benefit Associations (Mi-MBAs) via Zoom Videoconferencing.

Over 70 participants from 13 Mi-MBAs attend the Learning Session

“Ensuring Efficient CLIP Administration: The CARD MBA Way” on February 21 via Zoom.

MiMAP (RIMANSI) continues to provide support to its members by conducting learning sessions featuring various topics of interest to the microinsurance and MBA sector, including matters that will help Mi-MBAs and their partner microfinance institutions/cooperatives continuously cope and thrive in the post-pandemic era.

For the month of February, the learning session organized by MiMAP (RIMANSI) aimed to share the experience of CARD MBA in implementing the Credit Life Insurance Plan (CLIP), more specifically the features, policies and procedures of their CLIP. In addition, the challenges encountered by CARD MBA in their CLIP administration and the strategies and solutions they implement to address these challenges were discussed.

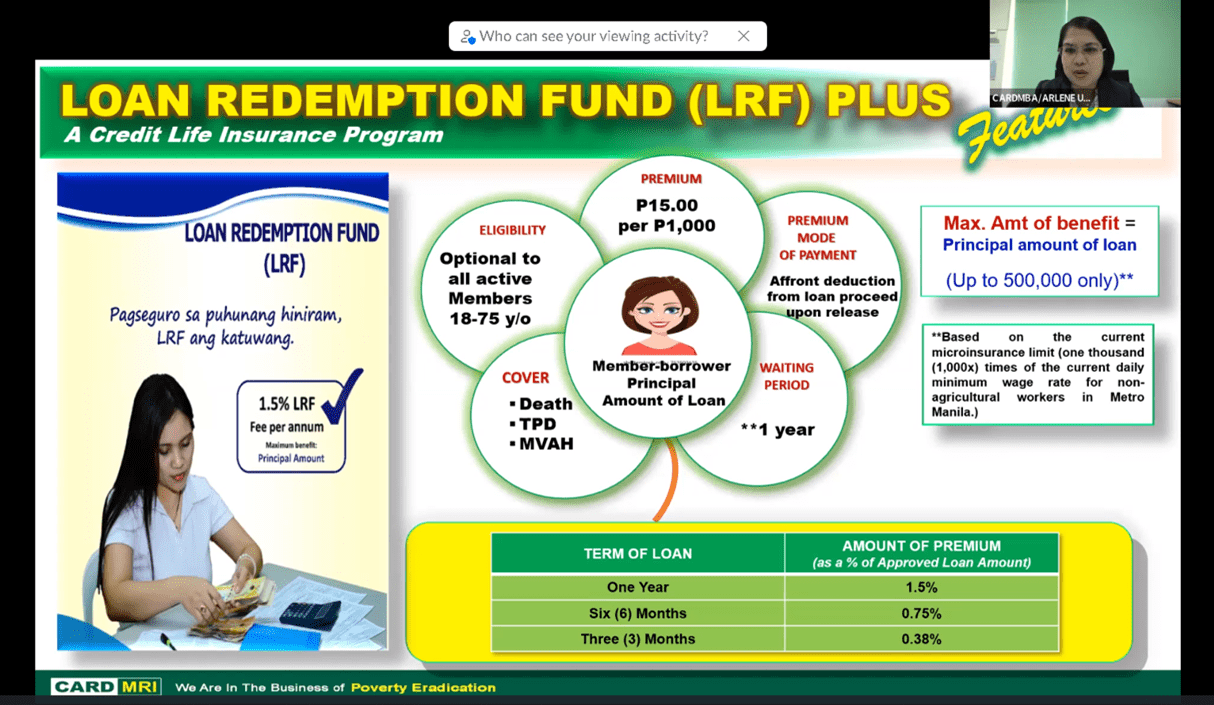

Ms. Arlene Umandap, Director for Claims and Tech Support of CARD MBA, served as the Resource Person of the learning session. She discussed CARD MBA’s CLIP or Loan Redemption Fund (LRF) Plus. Unlike an ordinary LRF, LRF Plus provides full loan protection to its member-borrowers by paying the total principal amount of loan to their members in case of death (the principal loan will be paid to the member-borrower’s beneficiaries). However, in case of Total and Permanent Disability, only the remaining principal balance of the loan will be paid by CARD MBA to the MFIs or the lending institutions.

CARD MBA Director for Claims and Tech Support and Resource Person Arlene Umandap presents the features of Loan Redemption Plus (LRF) Plus via Zoom.

In the claims settlement process, CARD MBA also upholds its 8–24-hour strategy. Upon filing a claim, the Unit Manager will check the member-borrower’s record. If entitled for claim, it will be endorsed to the MBA Coordinator who will then validate the claim and upload the required documents through the Panatag Ka mobile app. The uploaded documents will be automatically reflected in CARD MBA’s system and verified and assessed by a CARD MBA staff. Once the LRF claim is approved, the member-borrower’s beneficiary may claim the benefits through CARD Sulit Padala, and their savings (using Konek2CARD).

This process is made easier with the help of CARD partner MFIs by facilitating the loan disbursement, collecting and depositing LRF premiums, marketing and disseminating information about their products. Partner MFIs are also responsible in ensuring the compliance of their products with the rules and regulations set by the Insurance Commission and Bangko Sentral ng Pilipinas.

Furthermore, in the continuous effort to make the communication and submission of necessary documents easier for its members, CARD MBA and MFIs have now digitized their LRF Plus administration and are now in the roll-out stage. Ms. Umandap stated that the transition to a more digital approach was initially met with hesitance by its staff and members, but have now adapted.

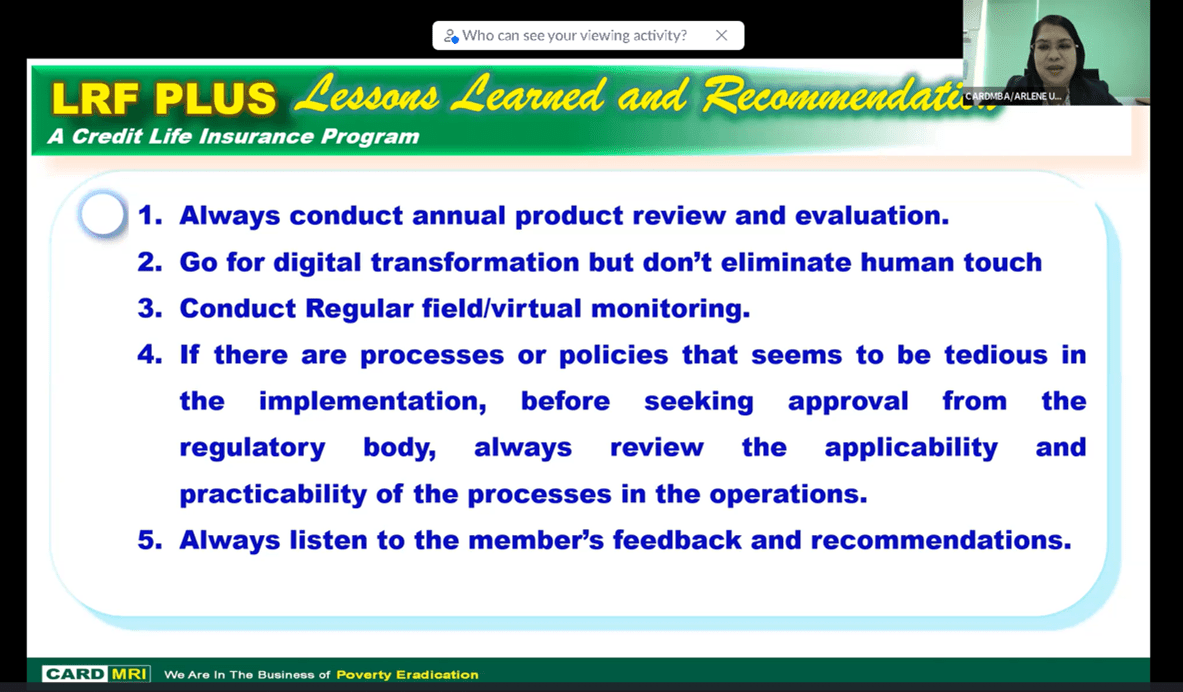

With this, Ms. Umandap advised Mi-MBAs to strive for digital transformation without eliminating human touch. “Very important sa kanila ang binibisita sila. So hindi po natin ‘yon inalis. ‘Yung pagpunta po doon ay not only for validation but to also show care sa kanila,” Ms. Umandap added.

CARD MBA Director for Claims and Tech Support and Resource Person Arlene Umandap

shares lessons and recommendations of CARD MBA in CLIP administration.

Additionally, annual product reviews and evaluations, together with regular field monitoring, must also be conducted to ensure the products’ sustainability and viability.

Lastly, Ms. Umandap emphasized listening to member feedback and recommendations. “When listening to your members, use your heart, but also use your calculator before implementation,” she further commented. Attainable and effective recommendations are strongly encouraged and valued by CARD MBA.

MiMAP (RIMANSI) will again hold its learning session in March 2023.

About MiMAP (RIMANSI):

The Microinsurance MBA Association of the Philippines Inc. (MiMAP) or RIMANSI helps professionalize the management of microinsurance mutual benefit associations (Mi-MBAs) and microinsurance programs to provide affordable, comprehensive, and quality risk protection to millions of poor people in Asia and the Pacific. Towards this purpose, MiMAP assists Mi-MBAs in developing risk management solutions, building capacities, advocating for appropriate policy environment, and pursuing research & development agenda.

###